Beyond Basic Creative Testing: A Proven Framework for Perpetual Digital Creative Optimization

.jpg?width=560&height=420&length=560&name=Frame%201%20(1).jpg)

Dynamic Content Orchestration: Scaling Data-Driven Personalization with AI and Automation

Learn how to orchestrate dynamic content at scale using AI and automation—improving speed, personalization, and cross-team efficiency.

Read More

Decluttering Your MarTech Stack

Decluttering the MarTech stack of redundant, underused solutions and opting instead for a cohesive, lean strategy can save time.

Read More

Artificial Intelligence for Dynamic Content Orchestration

Exploring AI for dynamic content orchestration? Learn to apply AI for marketing, automate tasks, personalize content, and enhance customer engagement for success.

Read More

Business Process Automation for Dynamic Content Orchestration

Unlock the future of dynamic content orchestration with BPA. Elevate efficiency, boost satisfaction, and innovate with Dynamic Content Automation.

Read More

Innervate-at-a-Glance

Learn how Innervate, the dynamic content orchestration company, can grow your personalized marketing at scale.

Read More

Activate Your Customer Data

Unlock the power of your customer data for game-changing dynamic content orchestration. Download our checklist to transform your team into a marketing powerhouse. Drive value. Scale now.

Read More

How to Scale Personalized Dynamic Content with Creative Automation

Reduce time and expenses with creative automation, which gives you control and insight into the process without making marketing exhausting.

Read More

Scaling Retail Media for Rapid Growth

Here’s what every business needs to understand about the retail media boom—and why it’s so critical to choose the right partner.

Read More

Activating Your DMP

78% of consumers prefer personalized content, but only 28% believe what they are served are relevant. Information about our prospects is readily available to create compelling ad creatives tailored to a market of one.

Read More

4 Solutions for Overcoming Your CX Challenges

Download the infographic to learn how to solve customer experience challenges such as technical problems, connectivity issues, budget challenges, and more.

Read More

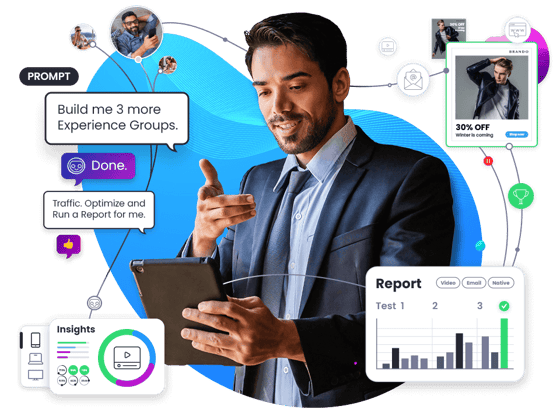

Beyond Basic Creative Testing

While you’ve probably heard terms like iterative testing and concept testing, how do you use these methods? Do you stick with just one, or use both – and if both, how? How do you prioritize and order your tests so they’re both efficient and effective?

Read More

Radically Simple Personalization at Scale

Traditional dynamic creative optimization (DCO) doesn’t cut it anymore. Your customers expect to be shown that you know what they want, where and when they want it. And they expect to see it now.

Read More

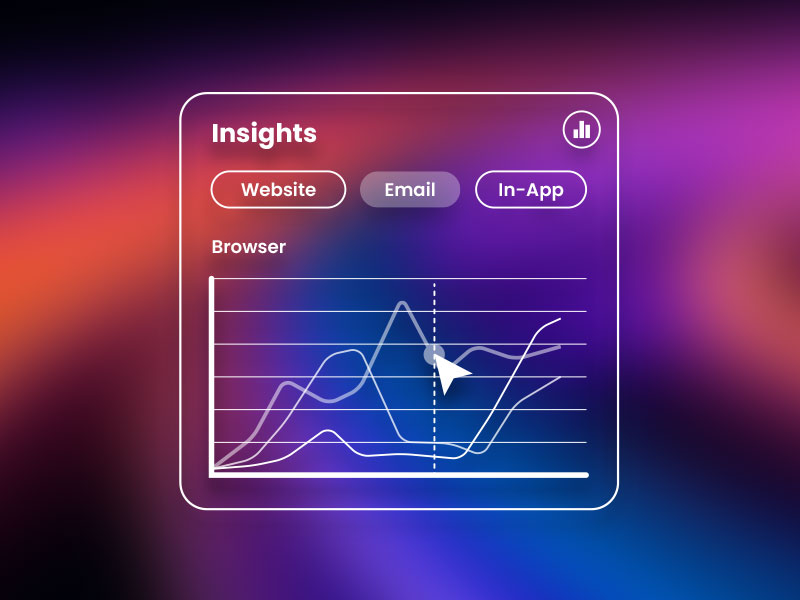

Reporting in Innervate

What insights can be gained from analytics and what are the most commonly used metrics? Innervate’s suite of reporting tools is flexible, powerful, and simple to use. You can develop custom reports that can be manipulated within the platform or exported.

Read More

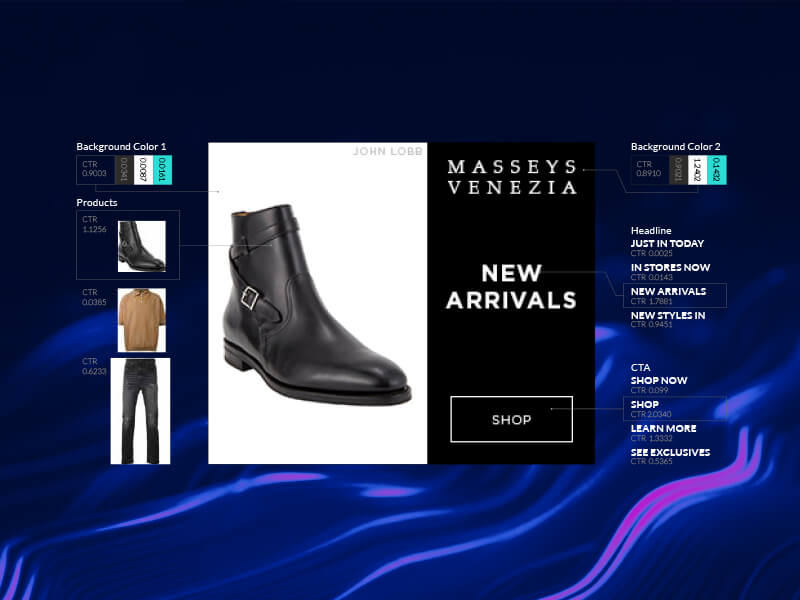

The Anatomy of Smart Creative

How do you leverage key insights through semantic ads? Innervate takes a unique approach when it comes to defining and recognizing elements of ads which affects all aspects of the process from trafficking to testing.

Read More

How to Build an In-House Creative Optimization Team

Critical roles for supporting continuous ad optimization

Read More

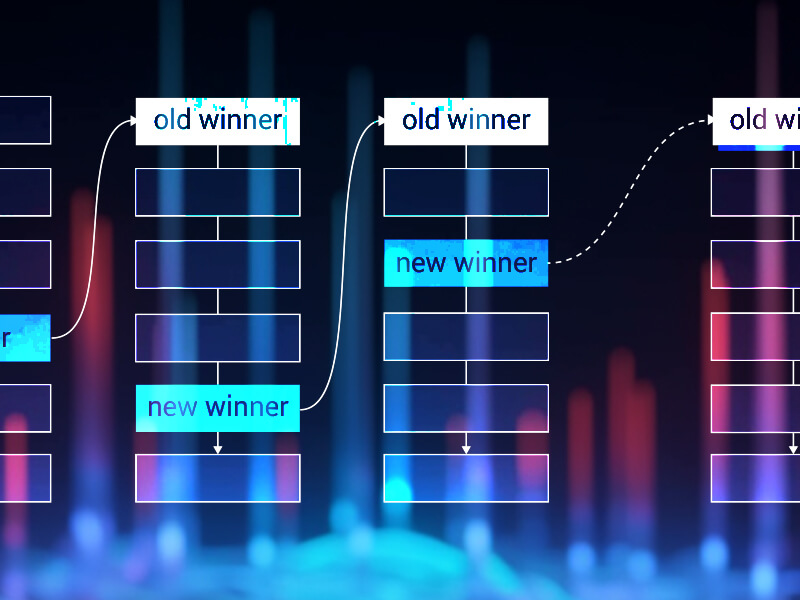

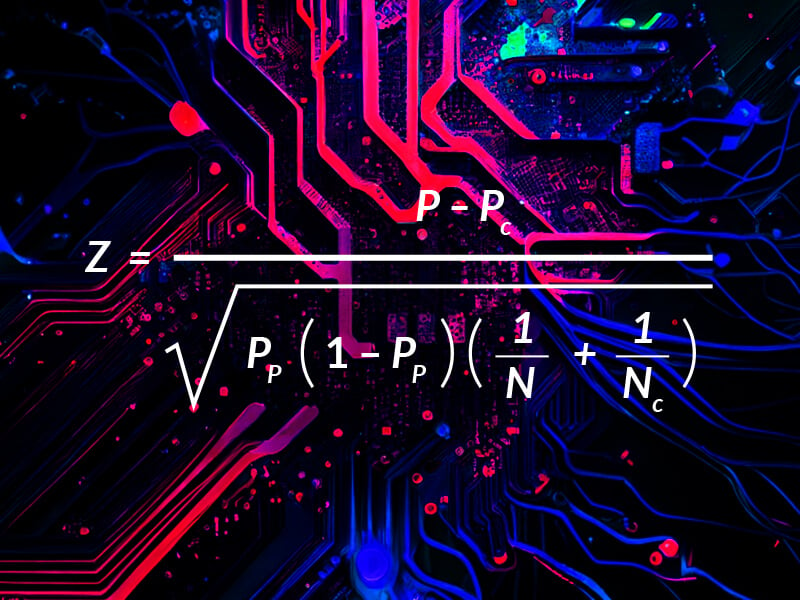

The Innervate Testing Methodology

Innervate enables high-velocity creative testing that drives ad creatives to perpetually improve. Reduce wasted media spend by minimizing the number of impressions required to declare – with statistical significance – when one or more ad creatives are inferior to the others.

Read More

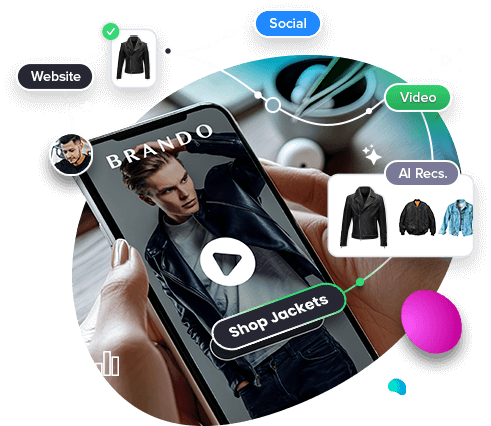

Dynamic Content for Websites and Landing Pages

Learn more about dynamic content for landing pages and websites with Innervate.

Read More

Innervate for Dynamic Email Content: Achieving Personalization and Efficiency

Supporting connection and conversion through engaging email marketing

Read More

Innervate for Dynamic Social Media Content

Captivate Audiences and Boost conversions with dynamic content in “walled gardens”

Read More

Innervate for Dynamic Audio Advertising

Dynamic audio ads can help you tap this market by using listener context—location, interests, and recent activity—to deliver hyper-personalized messages.

Read More

Innervate for Dynamic Video Content

Revolutionizing dynamic video with precision and efficiency

Read More

Innervate for Direct Response

Real-time content personalization to drive ROI and engagement

Read More

Innervate for Financial Services

Orchestrating dynamic content to create stronger customer relationships

Read More

Innervate for Retail & Ecommerce

Leveraging customer data platforms and AI for unparalleled, real-time content personalization

Read More

Innervate for Travel & Hospitality

Engage your customers around the world with omnichannel personalized content at scale

Read More

Innervate for Dynamic In-Store Content

Smarter In-Store Screens. Stronger Customer Impact.

Read More

Innervate for Telecom

Dynamic content orchestration to drive engagement and loyalty

Read More

Innervate for Dynamic Digital-Out-Of-Home Content

Deliver dynamic, real-time outdoor advertising that adapts to your audience's context.

Read More

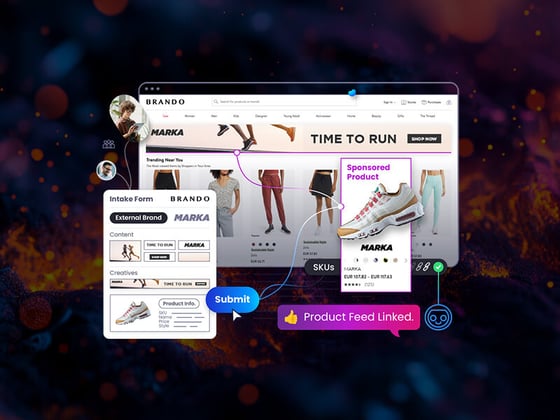

Innervate for Dynamic Retail Media Advertising

Dynamic Retail Media Ad Creative That Delivers

Read More

Innervate for Dynamic SMS

Real-time SMS marketing that drives action

Read More

Product Brief: First-Party Data

Third-party data is making its way out. First-party data can help you thrive in a shifting marketing climate. Innervate makes it easy.

Read More

Dynamic Audience & Creative

Dynamic Audiences & Creative features power the creation and targeting of intelligent creative.

Read More

Apps Available on the Orora AppXchange

Innervate is powered by the Orora AppXchange, which easily allows the installation of dozens of purpose-built Marketing Creative apps to power every aspect of your digital marketing.

Read More

Trafficking for the Continuous Creative

Innervate's creative testing methodology enables high-velocity creative testing that drives ad creatives to perpetually improve. Innervate has changed the methodology behind trafficking ads, without making ad operations’ job more complicated.

Read More

Marketing Intelligence

The underlying framework includes systems for increasing intelligence across creative production, audience management, and optimization experiments.

Read More

One-Click DCM Integration

Many companies use Google's DoubleClick Campaign Manager (DCM) as the single-source-of-truth across all digital platforms.

Read More

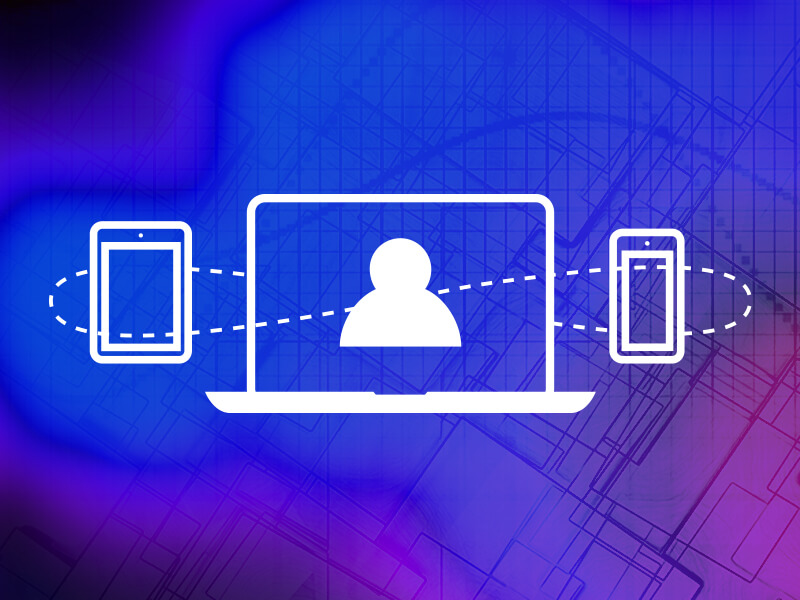

Innervate Overview

Modern digital marketers are taking control and orchestrating dynamic omnichannel content with Innervate - a unified, enterprise-grade platform.

Read More

Ecommerce Case Study

Read the Ecommerce Case Study to learn how our customer partnered with Innervate for an innovative approach to automated campaign management.

Read More

Retail Case Study

A retail leader wanted to modernize their approach to managing and executing marketing creative to more effectively promote their annual holiday sale, an incredibly important event for them.

Read More

Otto

OTTO Standardizes on Innervate to scale efficiently, drive performance, and promote innovation

Read More.jpg?width=560&height=420&length=560&name=CaseStudy_Direct%20Response_thumb_v1a%20(1).jpg)

Direct Response Case Study

With a directive of driving digital advertising for industry powerhouses, this direct response leader was on a digital advertising mission: drive quality leads at scale with maximum efficiency.

Read More

LendingTree

LendingTree Turbo Charges Creative Optimization on Innervate

Read MoreWhy Innervate?

Innervate provides the lightweight connective infrastructure to simply and seamlessly orchestrate data-driven, personalized dynamic content across all channels and formats. With Innervate, global marketing teams realize near-immediate benefits by seamlessly rolling out timely, dynamic content use cases across all digital advertising and customer experience touch points —inexpensively, at their own pace.

@2x.jpg?width=560&height=420&length=560&name=2025-10-Thumbnail-innervate-What%20Your%20Content%20Marketing%20Platform%20Can%E2%80%99t%20Do%20(Yet)@2x.jpg)